|

Global Assessment Report on Disaster Risk Reduction 2015

Making development sustainable: The future of disaster risk management |

|

Global Assessment Report on Disaster Risk Reduction 2015

Making development sustainable: The future of disaster risk management |

|

|

66

Part I - Chapter 3

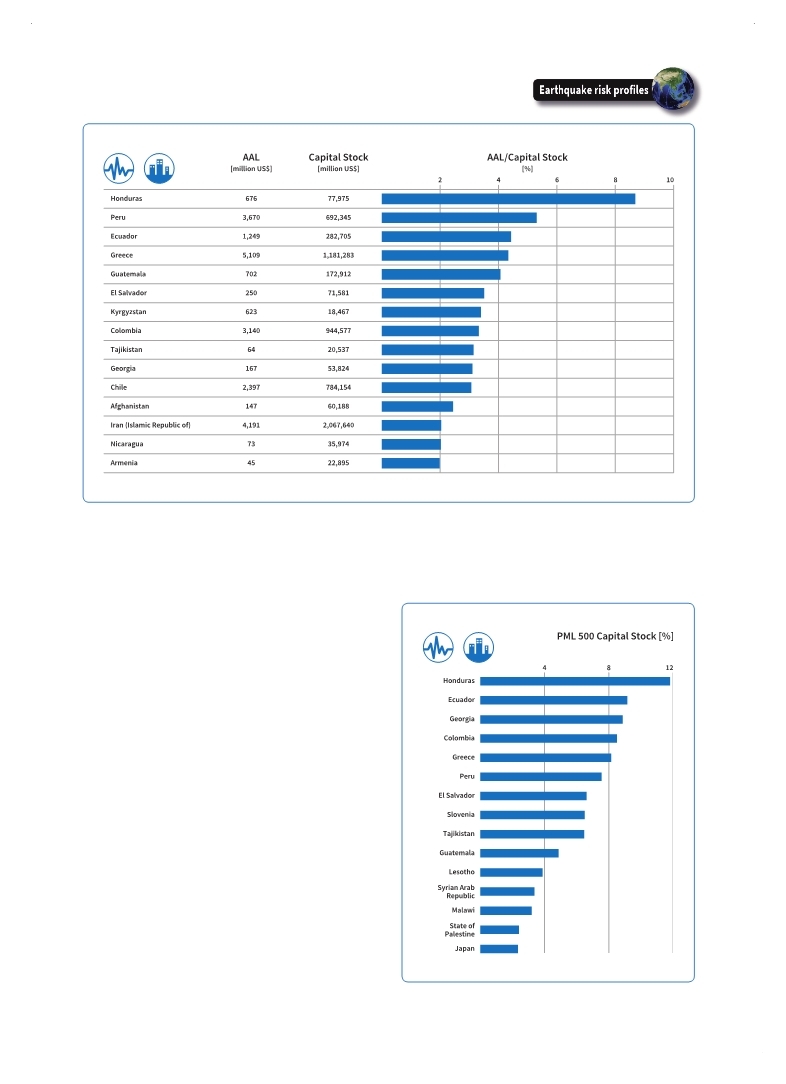

Figure 3.13 Top 15 countries: Earthquake AAL in relation to capital stock (excluding SIDS)

(Source: UNISDR with data from Global Risk Assessment and the World Bank.)

2.5 per cent of its building stock. This investment is now just over half of that observed in upper middle-income countries such as Peru. As a result, Greece’s earthquake AAL has come to represent 10 per cent of its annual capital investment.

In terms of PML, over a 20-year period there is a 4 per cent probability of a loss equivalent to the value of more than 8 per cent of Greece’s capital stock (Figure 3.14) and over 300 per cent of the country’s annual capital investment. The country’s AAL is also equivalent to almost 2.5 per cent of its national income (GNI). It is unclear whether this contingent liability was taken into account when the international community provided over EUR 200 billion in loans to support the Greek economy between 2010 and 2012. In reality, earthquake risk could spill over into the financial system and become increasingly systemic.

(Source: UNISDR with data from Global Risk Assessment.)

Figure 3.14 Top 15 countries: Earthquake PML500 in relation to capital stock (excluding SIDS)

|

Page 1Page 10Page 20Page 30Page 40Page 50Page 56Page 57Page 58Page 59Page 60Page 61Page 62Page 63Page 64Page 65Page 66Page 67->Page 68Page 69Page 70Page 71Page 72Page 73Page 74Page 75Page 76Page 77Page 78Page 79Page 80Page 90Page 100Page 110Page 120Page 130Page 140Page 150Page 160Page 170Page 180Page 190Page 200Page 210Page 220Page 230Page 240Page 250Page 260Page 270Page 280Page 290Page 300Page 310

|

|

|

|