|

Global Assessment Report on Disaster Risk Reduction 2015

Making development sustainable: The future of disaster risk management |

|

Global Assessment Report on Disaster Risk Reduction 2015

Making development sustainable: The future of disaster risk management |

|

|

103

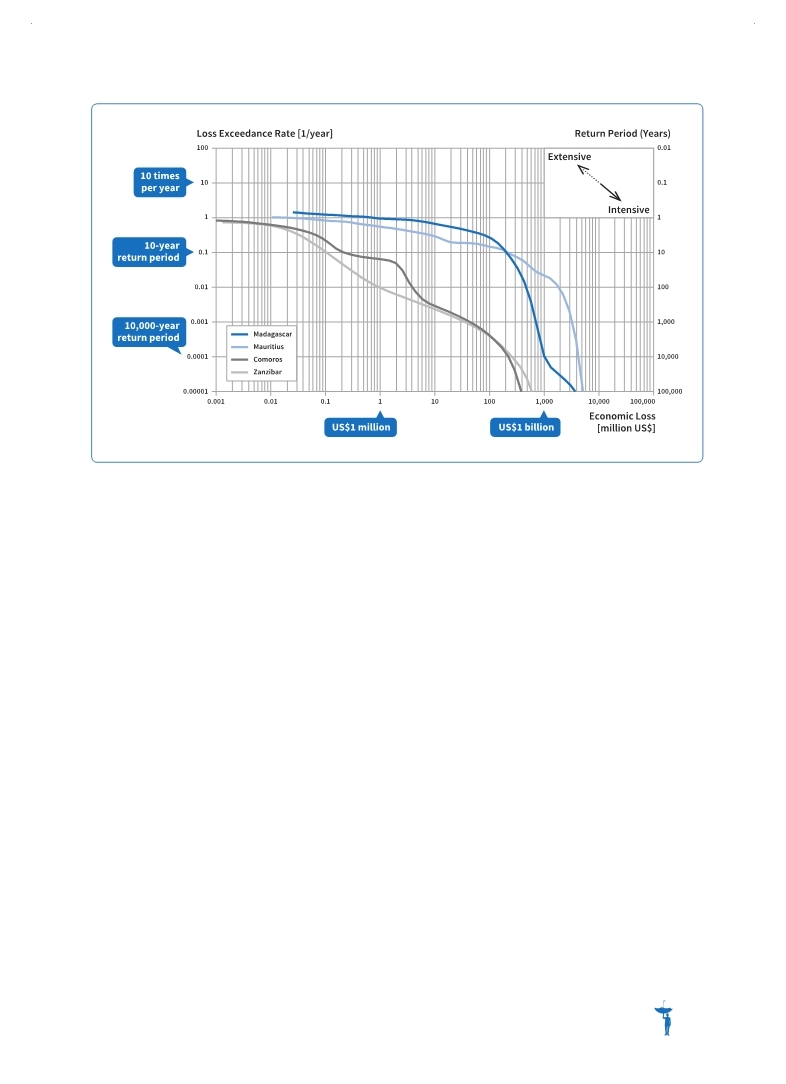

Coupled with the limited availability of reserve funds, contingent credit agreements, insurance and access to emergency financing options, the limited investments in reducing existing risk and avoiding the creation of new risk mean that many SIDS in particular are characterized by high risks and low economic resilience. In the Indian Ocean, calculating risk in Madagascar, Mauritius, Comoros and Zanzibar (Figure 5.3) has been a first step in identifying the threshold of loss levels where countries would struggle to finance a recovery. In these countries, losses with return periods of 500 years would require resources equal to 7 to 18 per cent of GDP (

Williges et al., 2014 Williges et al., 2014 Williges, Keith, Stefan Hochrainer-Stigler, Junko Mochizuki and Reinhard Mechler. 2014,Modeling the indirect and fiscal risks from natural disasters: Emphasizing resilience and “building back better”, Background Paper prepared for the 2015 Global Assessment Report on Disaster Risk Reduction. Geneva, Switzerland: UNISDR.. Williges, Keith, Stefan Hochrainer-Stigler, Junko Mochizuki and Reinhard Mechler. 2014,Modeling the indirect and fiscal risks from natural disasters: Emphasizing resilience and “building back better”, Background Paper prepared for the 2015 Global Assessment Report on Disaster Risk Reduction. Geneva, Switzerland: UNISDR.. Click here to view this GAR paper. Countries with large budget deficits are usually unable to divert funding from revenues to absorb disaster losses and therefore need to use other mechanisms, including taxation, national and international credit, foreign reserves, domestic bonds, aid and risk financing instruments. Using all these financing mechanisms, Mauritius would still face a resource gap for any losses from

cyclone wind and earthquake with a return period of 62 years or over (Figure 5.4). The corresponding return period is only 24 years for Madagascar and 28 years for Comoros (Mochizuki et al., 2014

Mochizuki, Junko, Stefan Hochrainer, Keith Wil-liges and Reinhard Mechler. 2014,Fiscal and Economic Risk of Natural Disasters in Comoros, Mauritius, Seychelles and Zanzibar, CATSIM Assessment (Preliminary Result). Risk Policy and Vulnerability Program, International Institute for Applied Systems Analysis (IIASA).. . A limited ability to absorb losses can increase the indirect economic costs of a disaster and can slow recovery (UNISDR, 2013a

UNISDR. 2013a,Global Assessment Report on Disaster Risk Reduction: From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction, Geneva, Switzerland: UNISDR.. .  Williges et al., 2014 Williges et al., 2014 Williges, Keith, Stefan Hochrainer-Stigler, Junko Mochizuki and Reinhard Mechler. 2014,Modeling the indirect and fiscal risks from natural disasters: Emphasizing resilience and “building back better”, Background Paper prepared for the 2015 Global Assessment Report on Disaster Risk Reduction. Geneva, Switzerland: UNISDR.. Williges, Keith, Stefan Hochrainer-Stigler, Junko Mochizuki and Reinhard Mechler. 2014,Modeling the indirect and fiscal risks from natural disasters: Emphasizing resilience and “building back better”, Background Paper prepared for the 2015 Global Assessment Report on Disaster Risk Reduction. Geneva, Switzerland: UNISDR.. Click here to view this GAR paper. (Source: UNISDR with data from CIMNE.)

Figure 5.3 Disaster risk in Zanzibar, Mauritius, Madagascar, and Comoros

|

Page 1Page 10Page 20Page 30Page 40Page 50Page 60Page 70Page 80Page 90Page 93Page 94Page 95Page 96Page 97Page 98Page 99Page 100Page 101Page 102Page 103Page 104->Page 105Page 106Page 107Page 108Page 109Page 110Page 111Page 112Page 113Page 114Page 115Page 116Page 117Page 120Page 130Page 140Page 150Page 160Page 170Page 180Page 190Page 200Page 210Page 220Page 230Page 240Page 250Page 260Page 270Page 280Page 290Page 300Page 310

|

|

|

|