What is holding back the promise of nature-based solutions for climate change adaptation?

By Heidi Tuhkanen

The case is increasingly clear that nature-based solutions offer cost-effective ways to address climate change adaptation. This perspective piece examines the issues that deserve greater attention to expand the use and financing of such measures.

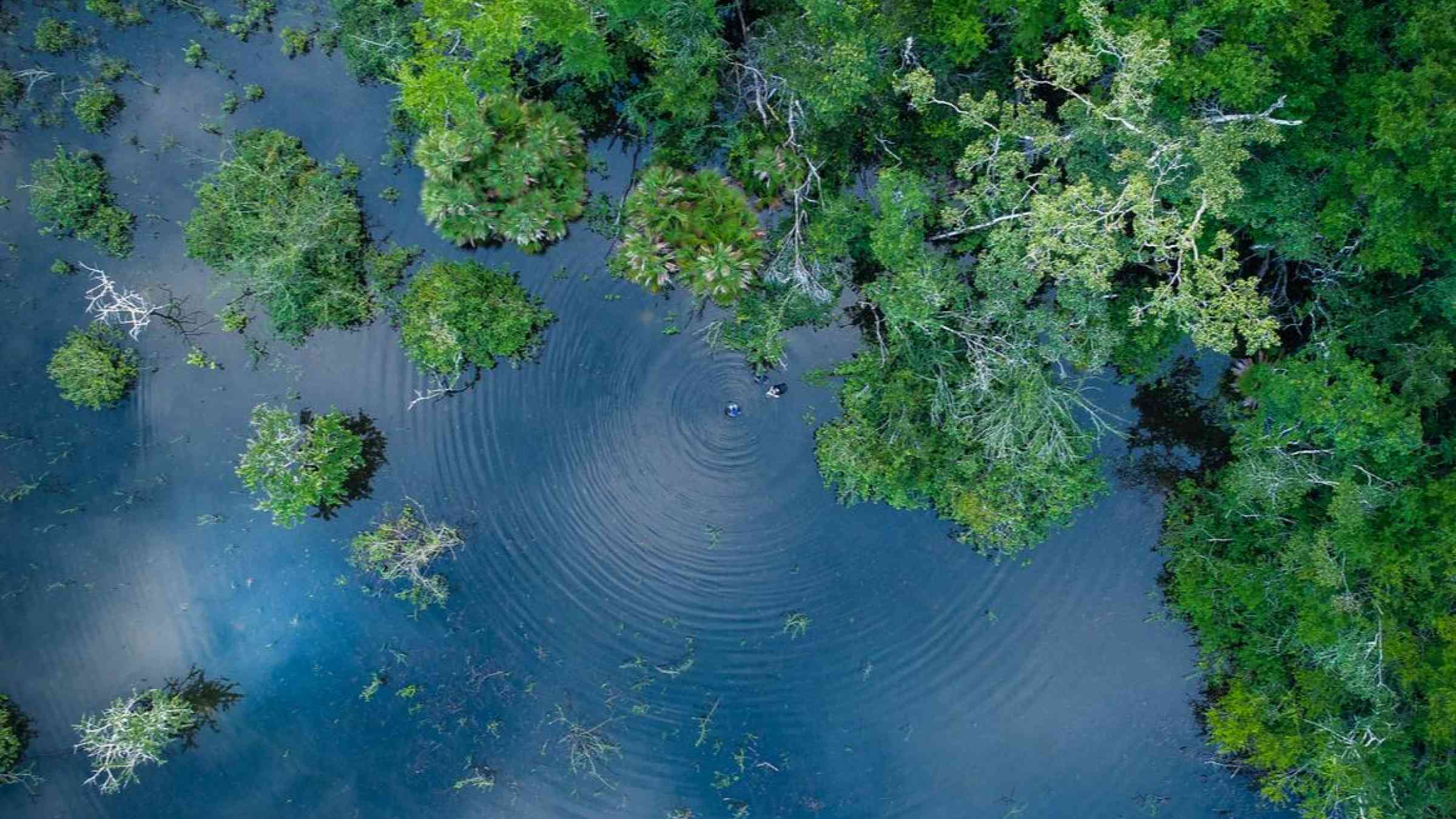

The benefits of using green infrastructure and nature-based solutions to address the adaptation needs arising from climate change are increasingly clear. Such projects have been shown to be cost effective, to provide social benefits, and also to mitigate emissions that contribute to climate change.

Meanwhile, the need is great. According to the Climate Policy Institute, an estimated $180 billion annually will be needed over the next decade to cover the cost of adaptation – a figure that the public sector cannot meet on its own. In recognition of the shortfall, finance mechanisms have surfaced to fund nature-based solutions by enabling investment from a range of private and public-sector actors.

So, why are so few projects in the pipeline?

The problem is certainly not a lack of interest. More than 150 people attended a recent seminar on the subject that I helped to organize with the UN Environment Programme and The Nature Conservancy at Climate Week NYC. Our seminar on private-sector adaptation finance and nature-based solutions in coastal areas (recording here) is one of many events, such as Financing Nature Based Solutions for Water Security and Financing Blue Carbon, that have recently explored the issue.

These events raise matters that must be addressed to generate greater investment in nature-based solutions, particularly in coastal and marine areas, and to capitalize on the potential of these strategies. Discussions at the Climate Week NYC seminar raised key insights about issues that should be high on the agenda.

Key insights from The Private-sector Adaptation Finance and Nature-based Solutions seminar

1. Expand understanding about the value of nature-based solutions.

All levels of government and the private sector need a greater appreciation for and awareness of the potential for nature-based solutions. More awareness is needed about the value of natural assets – and the far-reaching, cascading effects that their loss could have on societies and economies.

2. Increase the awareness of innovative financing tools.

Many of the finance mechanisms are new and being piloted in specific cases. People don’t know about them. At the seminar, a number of new financial mechanisms were presented. Blended finance mechanisms – like debt-for-nature swaps, risk- sharing instruments, and first-loss instruments – combine public- and private-sector finance to help offset the risks, and to distribute the benefits that nature-based-solution projects involve. Nature-based insurance is being used in Mexico to fund coral reforestation and maintenance, recovery from hurricane damage, and worker training for reef reparation. Fee-based funding – first in the form of a departure tax and currently in the guise of a Pristine Paradise Environmental Fee – is being used in Palau to transfer funds from tourists to the communities and governments that manage the Marine Sanctuary. Carbon credits in Kenya are funding community-based mangrove reforestation, which not only buffers disaster risks, but also captures carbon. Similar efforts are being replicated in other places. Furthermore, green and blue bonds exist, though they have yet to be used at high levels.

3. Understand the challenges of financing nature-based solutions.

Similar to many adaptation projects, nature-based solutions are often too small and too high risk to attract investors; thus, mechanisms are needed to pool, mainstream and de-risk projects. Projects also tend to be tailored to local conditions; pilots take time to get off the ground; and many of the effects are long term – all of which limit replicability. Further work, however, is being done to see how such arrangements could be replicated in other geographies and with other ecosystems. New ways are needed to manage natural resources and new partnerships between multiple stakeholders (public and private) to leverage private financing for projects that provide public goods and benefits. To push the demand for adaptation, higher standards and/or regulation, along with risk awareness are needed.

4. Address the issues posed by the neediest countries.

Many current examples of private-sector financed, nature-based models are from middle- and high-income countries. By contrast, low-income and least-developed countries are among the most vulnerable to climate impacts, and therefore in greatest need of investment. Private or blended finance opportunities are limited because of perceived high risk and low return on investment. My own research concludes that green bonds are limited in terms of their use in such countries as a mechanism to scale up private financing for adaptation and resilience.

5. Give greater attention to the trade-off between social and environmental benefits.

Livelihood benefits to communities are often mentioned as a component of nature-based solutions. What will the distribution of benefits be among stakeholders with private financers in the picture? How can projects ensure equitable access to benefits throughout society?

6. Examine the potential for hybrid measures to extend the benefits of nature-based solutions.

Hybrid nature-based solutions combine grey and green infrastructure. They may offer a way to increase the availability of alternatives to grey infrastructure. In fact, hybrid models may be the only solution available for some situations. For example, pure nature-based solutions may not be an option in dense urban areas, and may not be sufficient for adapting to severe climate impacts. Some hybrid models are actually traditional methods that are making a comeback. One example is the use of fences to start the formation of sand dunes to help protect coastal regions. However, innovation and experimentation with these solutions are needed to come up with new possibilities as well as to assess their effectiveness and replicability.

Although we are still far away from reaching the funding needed for adaptation, these new and diverse opportunities for private finance of nature-based solutions move us closer to the goal. The Global Commission on Adaptation recently called for the demonstration of innovative finance models to scale-up investments in nature-based solutions. This call specifically seeks to mobilize private finance. This call and other initiatives recognize the potential of such approaches. Nature provides benefits that are the backbone of societies and economies. It can also be the backbone of resilient adaptation.