Gender & risk finance - How climate risk insurance can turn four women’s lives around - 2022

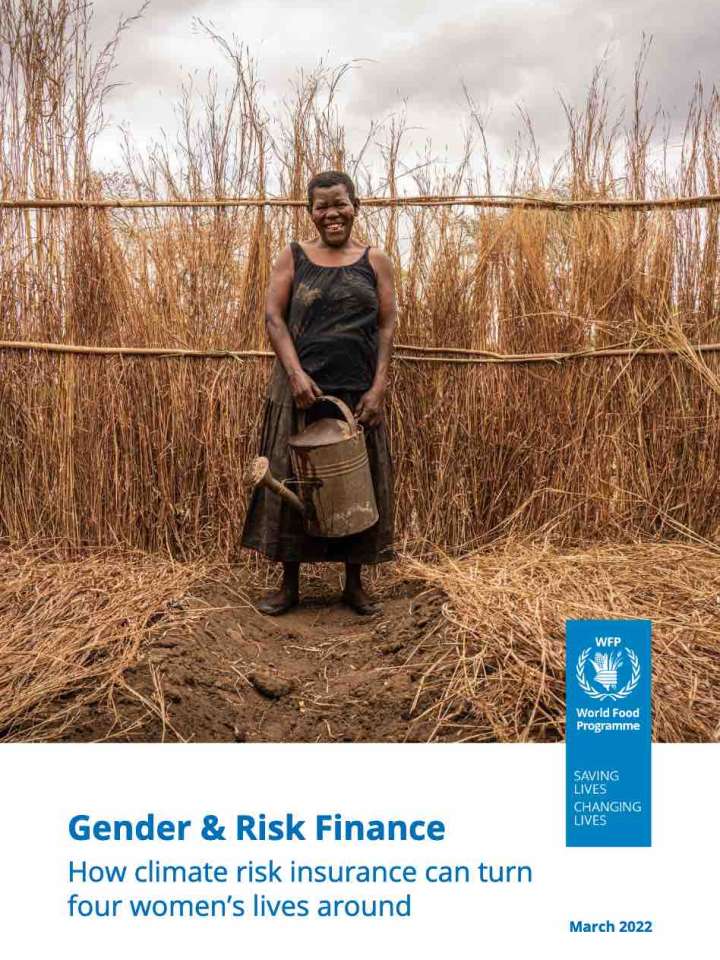

This publication showcases four women in Malawi, Guatemala, Madagascar and Nicaragua who thanks to risk finance were able to overcome climate shock, build resilience, and help their families and communities. As climate change increases the probability of climate-related disasters, people living in vulnerable areas and whose livelihoods are dependent on the weather grow at risk. For women, this risk increases as climate-related disasters can exacerbate pre-existing inequalities.

As climatic events occur, for women, and the families they take care of, this insurance acts as a safety net that they can count on to help them through the difficult times. Furthermore, insurance is the most effective when integrated with other risk management tools that improve productivity and the household asset base while reducing their underlying risk to disasters and increasing saving opportunities that help people absorb idiosyncratic and less extreme shocks. This gives women the possibility to think ahead, invest in improving their situation and not live in fear of the next extreme event or shock.

Explore further