Are there fundamental characteristics of systemic risks?

This is the fourth in a series of eight articles co-authored by Marc Gordon (@Marc4D_risk), UNDRR and Scott Williams (@Scott42195), building off the chapter on ‘Systemic Risk, the Sendai Framework and the 2030 Agenda’ included in the Global Assessment Report on Disaster Risk Reduction 2019. These articles explore the systemic nature of risk made visible by the COVID-19 global pandemic, what needs to change and how we can make the paradigm shift from managing disasters to managing risks.

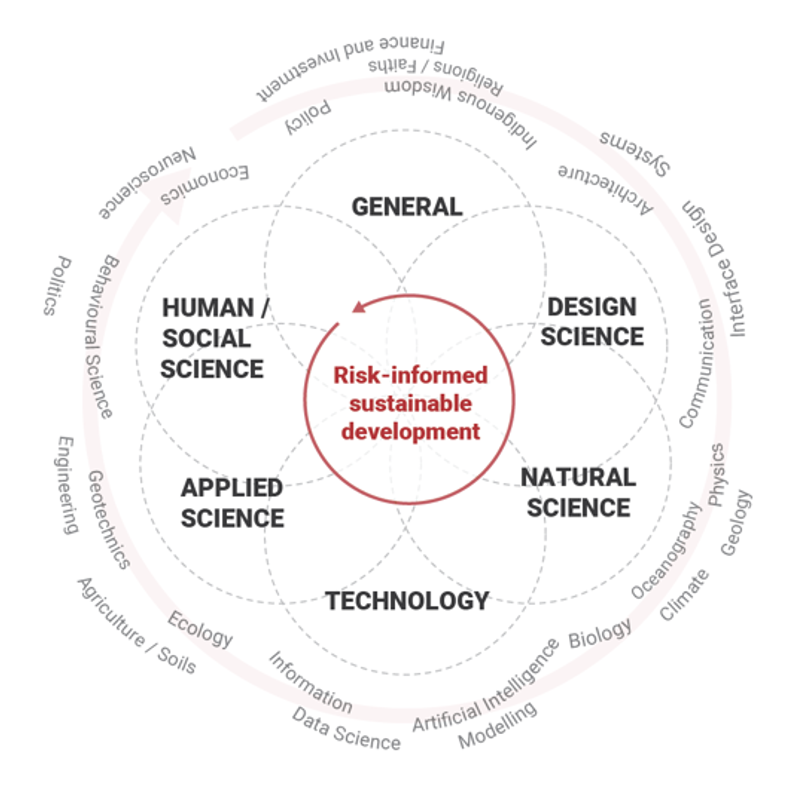

This is a deeper, more technical dive into important recent work predicated on the concepts discussed in the last article in this series (#3 of 8). They suggest that the shape of risk is similar in very different systems. The ‘homomorphism’ of systemic risks in different domains suggests that as attempts are made to understand the effects of endogenous triggers and critical transitions, there will be more patterns apparent in different domains. This will allow the development of a consistent understanding of the fundamental characteristics of systemic risk.

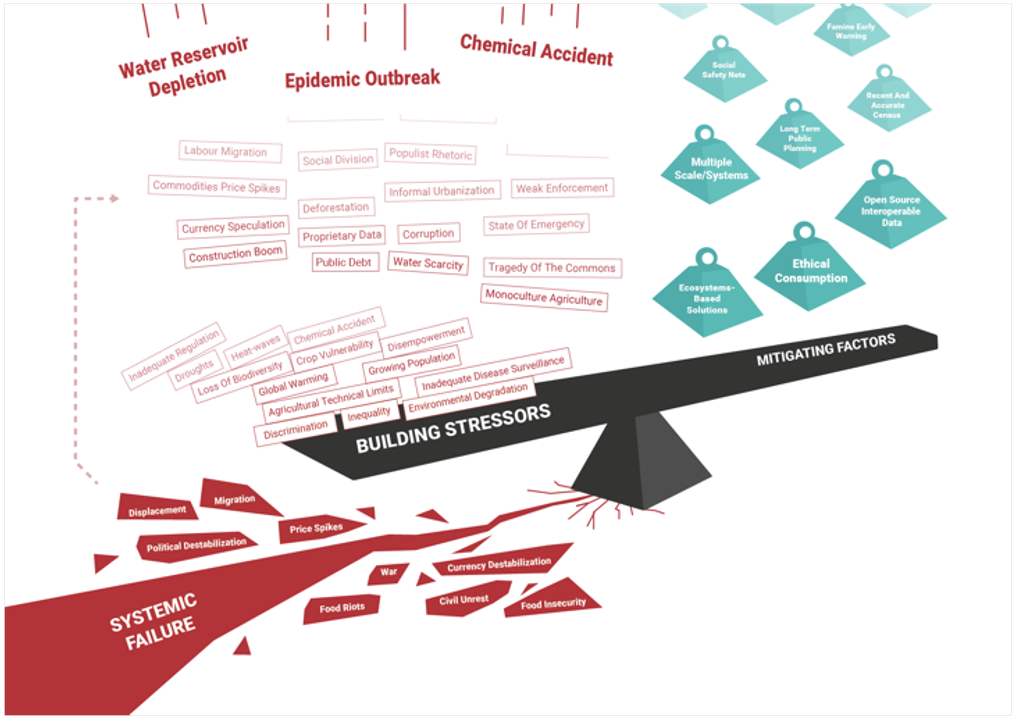

An apparently stable macro-configuration of a complex system - like the global aviation system - will break down, and will be re-shaped by amplifications of a series of micro-events (like restrictions of flights to and from just a small number of countries) until a new, stable macro-configuration emerges. To apprehend these critical aspects and to disseminate new approaches for decision makers at various scales (in a relatively simple-to-understand format), we need a more comprehensive understanding of the spatio-temporal dimensions of complex, systemic risks and the differentiated nature of 'complicated' and 'complex' systems.

To characterize systemic risks, which involves dealing with information gaps or ambiguity, it helps to capture the random patterns of possible disasters such as the COVID-19 pandemic on maps of values describing the vulnerability of people, infrastructure, economies and activities. A resulting systemic risk model will then allow for a quantification of mutually dependent losses in space and time. This will allow for the use of stochastic risk management models. Stochastic systemic risk assessment tools recognize complexity and the inherent unpredictability and chaos in complex systems.

These models do not try to simplify things to make calculations easier. They represent how complex components - such as interactions and interdependencies between disease spread vectors, human behaviour, health system infrastructure and other economic activities - are distributed across systems. And even if the probability is low, they encompass extreme events. This is known as distributional heterogeneity and additivity of extreme events. The global COVID-19 pandemic is an example of a low probability, extreme event. Such systemic risk tools are thus difficult to establish. The approach differs from multi-hazard modelling which relies on “regularity assumptions”. These attempt to make reality less complex and disorderly to ease calculation.

Scenario analyses and stochastic simulations are in use in many applications in the financial sector, including in the insurance industry. Their purpose in the insurance sector is to identify and evaluate risks and to examine possible interconnections and amplifications among them. For example, in the area of natural hazards, they simulate earthquake strength and possible hurricane paths, they define impact scenarios and they analyse potential losses. The findings are then used for pricing, internal guidelines, public policy and management of a portfolio of insured assets.

To focus the attention of analysts and decision makers on the indicators that best capture the character of systemic risk, the impending phase transitions and regime changes of the underlying complex systems, we need new approaches to modelling and understanding of the nature of systemic risks.

If appropriately co-produced, systemic risk modelling will uncover the incentives driving policymaker resistance to going beyond conventional views of risk and those allowing salient early warnings from systemic risk indicators to be ignored or rejected.

The adoption of a multi-agent system in assessments subject to systemic risk is an emerging approach. But it is becoming more and more important, particularly in the context of the COVID-19 pandemic. This approach represents network effects and considers the random nature of human behaviour and (emotional) decision making. A multi-agent system is a loosely coupled network of software agents. These interact to solve problems beyond the individual capacities or knowledge of each problem solver. Certain agents may pose a deliberate threat such as delaying restrictions of movement of populations already experiencing the early stages of exponential cases of infection. People being unaware of the exponential effect of not practicing distancing may pose an unintentional threat. In such cases, systemic risk management requires other agents across all interconnected and interdependent subsystems to take countermeasures to maintain the integrity of the entire system. The application of multi-agent systems research is appropriate and appealing as a way of providing decision friendly scenarios and options to policy makers attempting to manage complex, systemic risk events such as the COVID-19 pandemic.

As is now understood in country after country, systemic risks might be easy to mitigate early. Yet failure (or even intentional ignorance) to appreciate the role of underlying drivers of systemic risk will allow small, manageable risks to grow into major whole-of-society problems. Failed interventions and missed opportunities will increase both economic and human losses. Developing and implementing multi-disciplinary and transcontextual approaches to identify and act on precursor signals and systems anomalies is critical to reduce or avoid discontinuities in critical interdependent complex systems.

To date, assessment and management methodologies for systemic risks are still in early gestation. They are not yet part of the current operations of twenty-first century risk management institutions. Nonetheless, with the onset of the COVID-19 pandemic, there is a growing sense of urgency for a paradigm shift. This is hitting every major twentieth century risk management institution, from governments to insurers. The limitations of the linear constructs of that era are now revealed, with the occurrence and prospect of massive failures across and between systems.

Now is the time to experiment, to explore and invest in developing new approaches, to try to understand the fundamental characteristics of systemic risks. These should be applied, assessed and finessed in managing the COVID-19 pandemic. This may then, by extension, be applied to the potential specificities limiting vulnerabilities of other complex, systemic risks, such as the climate and ecological crises.

Building off this discussion of the characteristics of systemic risk, the next article in this series (#5 of 8) explores the need to improve decision making capabilities, in particular during complex, cascading risk events such as the COVID-19 pandemic. It will also explore opportunities to renovate governance approaches to be able to better focus on the systemic nature of risk.