|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

|

|

87

more resilient than smaller economies, heavily dependent on single economic sectors (UNISDR, 2009

UNISDR. 2009.,Global Assessment Report on Disaster Risk Reduction: Risk and poverty in a changing climate., United Nations International Strategy for Disaster Reduction., Geneva,Switzerland: UNISDR.. .  Gencer, 2012 Gencer, 2012 Gencer, E. 2012.,The Impact of Globalization on Disaster Risk Trends: A Macro- and Urban- Scale Analysis., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Gencer, E. 2012.,The Impact of Globalization on Disaster Risk Trends: A Macro- and Urban- Scale Analysis., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. Although further research is required to reconcile the results from different economic models, recent studies show that in the medium (Hochrainer, 2009

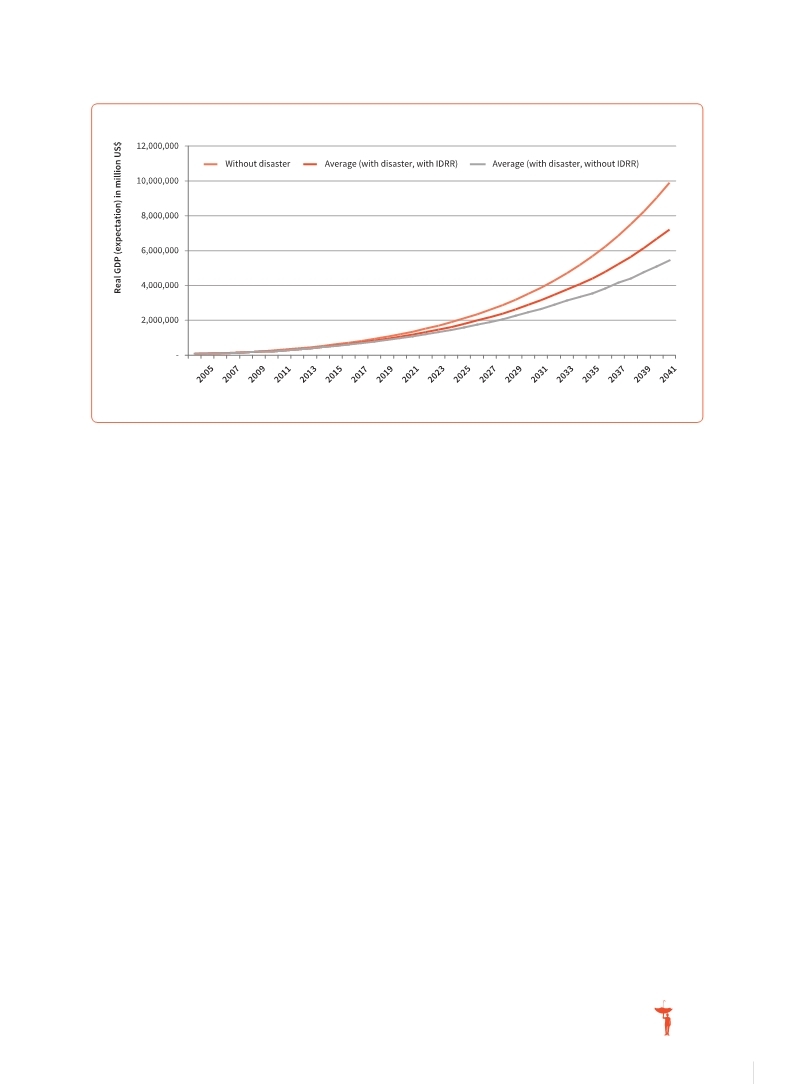

Hochrainer, S. 2009.,Assessing the Macroeconomic Impact of Natural Disasters: Are there any?, Policy Research Working Paper 4968., Washington: World Bank,. . Hsiang, S.M. and Jina, A.S. 2012.,Development after Disaster., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. . New simulations of the impact of disaster risk reduction measures on economic growth also show useful results. In Pakistan, for example, an analysis

of economic growth projections shows that although real GDP growth would be impacted by a major disaster event, investments in disaster risk reduction could significantly curtail this impact (Figure 5.11).

The impacts of disasters on economic growth over time can be understood when assessing potential midto long-term macroeconomic impacts. In Honduras, a one-in 100 year event could produce direct losses amounting to 33 percent of its GDP. Given its limited ability to finance this loss, the government also would have to prepare for further cumulative consequences over time, estimated at up to almost 24 percent of GDP over a period of 5 years (Figure 5.12).

Currently, national accounting does not adequately measure disaster impacts. On the contrary, accounting systems usually report reconstruction and relief spending, adding to GDP figures. Disaster risk may be included in new approaches to wealth accounting at the national level such as adjusted savings, v to improve risk management and financing strategies in the future (Mechler, 2009

Mechler, R. 2009.,Disasters and Economic Welfare. Can National Savings Measures Help Explain Post Disaster Changes in Consumption?, Background Paper for Chapter 2 of World Bank/UNISDR 2010: Natural Hazards, Unnatural Disasters., https://www.gfdrr.org/node/284,. . Figure 5.11 Simulation for Pakistan (IDRR = investment in disaster risk reduction)

|

|