|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

|

|

226 Part III - Chapter 15

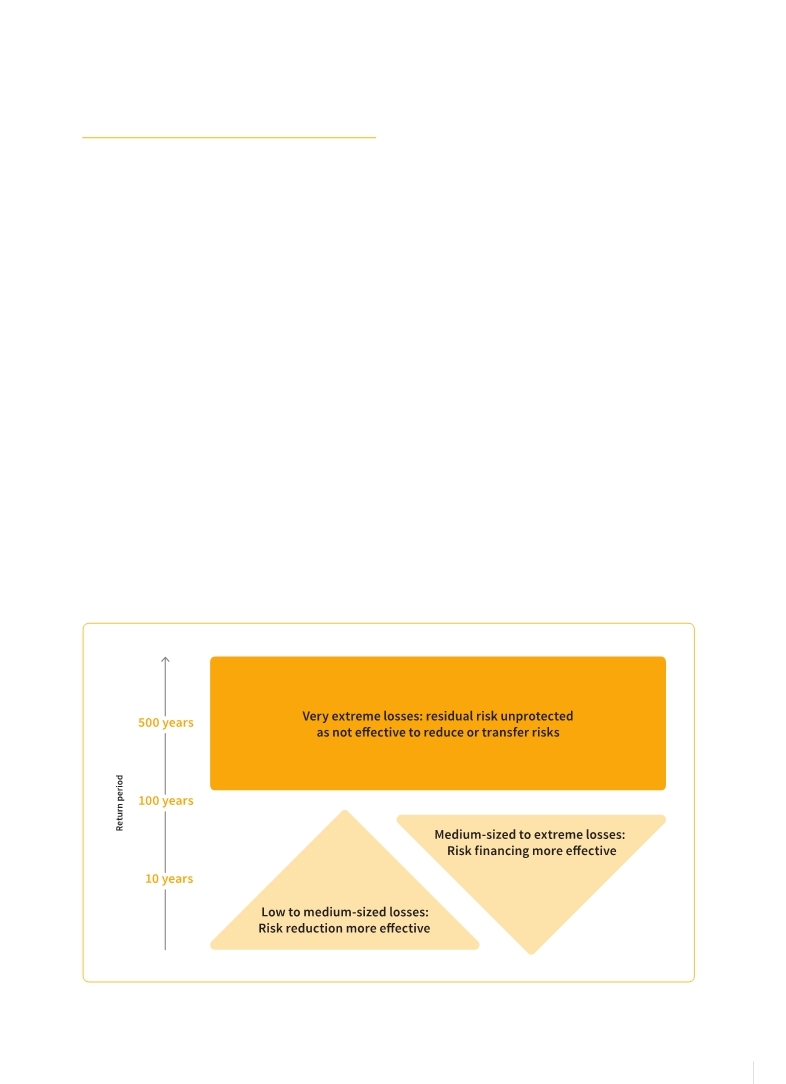

Figure 15.1 Efficiency of risk management instruments and occurrence probability

15.2

Growing commitment

to risk financing

As long as risk financing strategies reflect a vision of disasters as exogenous shocks rather than of risk as an endogenous characteristic of investment flows, the cost of risk financing is likely to grow—except in countries that are making major investments in risk reduction.

In times of constrained public budgets, strengthening financial resilience is becoming a critical task for hazard-exposed economies worldwide (Government of Mexico and World Bank, 2012

Government of Mexico and World Bank. 2012.,Improving the Assessment of Disaster Risks to Strengthen Financial Resilience., A Special Joint G20 Publication by the Government of Mexico and World Bank. 2012 International Bank for Reconstruction and Development / International Development., Washington DC,USA. Available at https://www.gfdrr.org/G20DRM. UNISDR. 2011.,Global Assessment Report on Disaster Risk Reduction: Revealing Risk, Redefining Development., United Nations International Strategy for Disaster Reduction., Geneva,Switzerland: UNISDR.. . In the case of medium-sized to extreme losses, however, risk financing is essential to ensure macroeconomic stability and to facilitate financing of recov-

ery and reconstruction. As Chapter 4 of this report highlighted, many countries with high levels of disaster risk would face a serious financing gap in the event of a major disaster.

Table 15.1 shows the diversity of recent experience in risk financing. For example, Mexico is transferring risk to capital markets via catastrophe bonds. The parametric index used in this case allows prompt payment, made as soon as the predefined event occurs while ensuring relatively high levels of transparency (Swiss Re, 2011

Swiss Re. 2011.,Economics of Climate Adaptation (ECA)-Shaping climate-resiliet development. A framework for decision-making., Zurich,Switzerland.. . G20/OECD. 2012.,Disaster Risk Assessment and Risk Financing. A G20/OECD Methodological Framework., Paris,France: OECD.. Available at http://www.oecd.org/gov/risk/G20disasterriskmanagement.pdf.. Swiss Re. 2011.,Economics of Climate Adaptation (ECA)-Shaping climate-resiliet development. A framework for decision-making., Zurich,Switzerland.. . There are other examples reported by countries through the HFA Monitor. The Government of Ethiopia has established robust mechanisms to finance

(Source: Mechler et al., 2012

Mechler, R., Hochrainer, S., Linnerooth-Bayer, J. and Pflug, G. 2012.,Public Sector Financial Vulnerability to Disasters. The IIASA CatSim Model., In: Birkmann, J. (eds.): Measuring Vulnerability to Natural Hazards. Towards Disaster Resilient Societies., Revised and extended Second Edition,Tyo: United Nations University Press. . |

|