|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

|

|

196 Part III - Chapter 12

(Source: UNISDR)

Box 12.3 Forecasting risk—lessons from Thailand?

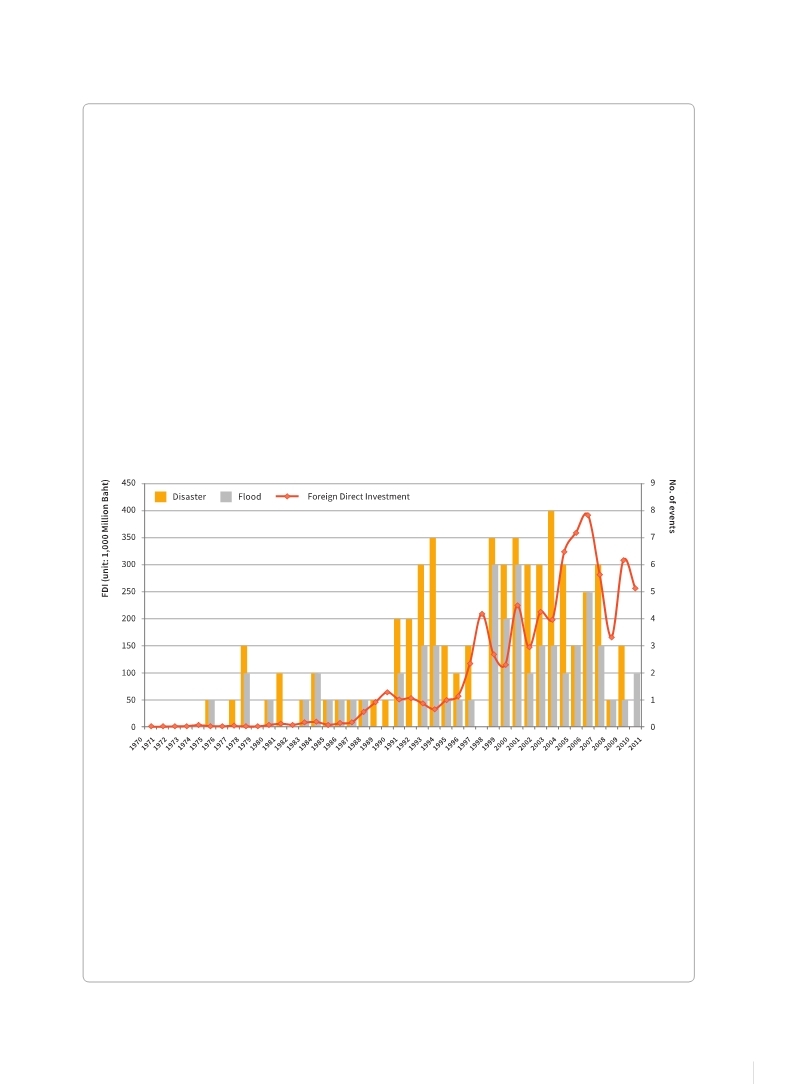

In October 2011, only a few weeks before the country’s economy was engulfed by the Chao Phraya river floods, the EIU, a major source for country risk profiles generated by businesses and investors across the globe, forecast an expansionary fiscal policy of the Thai Government for 2012 and estimated GDP growth of 3.8 percent in 2011 to 4.8 percent in 2012 (EIU, 2011a EIU (Economist Intelligence Unit). 2011a .,Thailand Country Report October 2011., London,UK.. . After the floods shut down more than 14,000 businesses nationwide, this estimate of real GDP growth was revised downwards to 2.5 percent in November and to 1.2 percent in December (EIU, 2011b EIU (Economist Intelligence Unit). 2011b.,Thailand Country Report November 2011., London,UK.. . Atradius. 2011.,Country Report: Thailand December 2011., Atradius Country Report, December 2011.. . A few months earlier, an investor country briefing by a major bank, based heavily on EIU data, did note that the export-heavy Thai economy was “very vulnerable to external demand shocks” (Rabobank, 2011 Rabobank. 2011.,Country Report Thailand, May 2011., Rabobank Economic Research Department., Utrecht,The Netherlands. . An empirical study of the relationship between foreign direct investment (FDI) flows and the occurrence of disasters over the last 40 years in Thailand shows that investment has not been influenced by disaster occurrence in general, and floods in particular (Figure 12.2;  Thampanishvong, 2012 Thampanishvong, 2012 Thampanishvong, K. 2012.,The Case of Thailand., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Thampanishvong, K. 2012.,The Case of Thailand., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. However, other studies covering 94 countries over a 20-year period have found a negative and significant relationship between disasters and FDI (Escaleras and Register, 2011 Escaleras, M. and Register, C.A. 2011.,Natural Disasters and Foreign Direct Investment., Land Economics Vol. 87(2): 346-363.. . In Thailand’s 2012 economic forecast briefing, flood risk is mentioned, suggesting that the “perfect storm of factors that combined to produce the floods in 2011” were not in place for 2012 (EIU, 2012e EIU (Economist Intelligence Unit). 2012e.,Thailand politics: Quick View - Flooding flashpoint., EIU Viewswire, 3rd September 2012., London,UK.. . (Source:

Thampanishvong, 2012 Thampanishvong, 2012 Thampanishvong, K. 2012.,The Case of Thailand., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Thampanishvong, K. 2012.,The Case of Thailand., Background Paper prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. Figure 12.2 FDI and disaster occurrence in Thailand from 1970 to 2011

|

|