|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

Global Assessment Report on Disaster Risk Reduction 2013

From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction |

|

|

|

188 Part III - Chapter 11

expand and include prospective risk management (DKKV, 2012

DKKV (Deutsches Komitee Katastrophenvorsorge). 2012.,Mobilisierung des Privatsektors zur katastrophenpräventiven Anpassung an den Klimawandel., Teilstudie Deutschland., Bonn, Germany: BMZ, GIZ and DKKV.,. . A number of businesses also recognise the value of collaborating and sharing their knowledge and expertise with the public sector (

PwC, 2013 PwC, 2013 PwC (PricewaterhouseCoopers). 2013.,UNISDR and PwC – Working together to reduce disaster risks., Report prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. PwC (PricewaterhouseCoopers). 2013.,UNISDR and PwC – Working together to reduce disaster risks., Report prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. Businesses usually employ four distinctive strategies—similar to those considered by governments or communities—to manage exposure to risks, depending on their risk appetite and exposure profile (Figure 11.3).

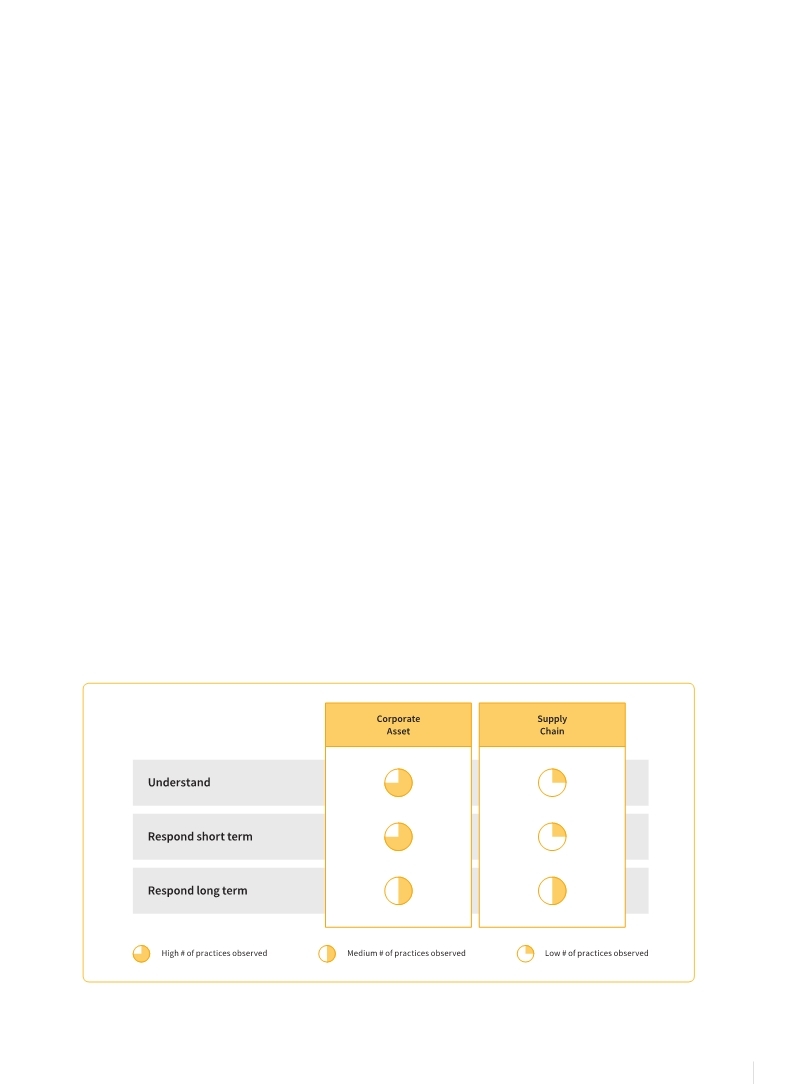

However, when global corporations were asked about their existing disaster risk management strategies, many show low levels of maturity vis-à-vis long-term risk reduction and prospective risk management (

PwC, 2013 PwC, 2013 PwC (PricewaterhouseCoopers). 2013.,UNISDR and PwC – Working together to reduce disaster risks., Report prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. PwC (PricewaterhouseCoopers). 2013.,UNISDR and PwC – Working together to reduce disaster risks., Report prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. means that although there are good practices to be shared in understanding and responding to immediate risks to corporate assets, longer-term risks and risks to supply chains are less well understood (Figure 11.4).

Unsurprisingly, levels of maturity in understanding asset exposure and associated risks vary significantly. Although many companies rely on insurance providers to conduct risk assessments of their major assets, innovative examples exist. One of the global corporations consulted for this report creates ‘heat maps’ of each of its sites by overlaying company data on hazard and risk maps, setting up global risk standards and creating local compliance registers in line with the company’s global risk standards (

PwC, 2013 PwC, 2013 PwC (PricewaterhouseCoopers). 2013.,UNISDR and PwC – Working together to reduce disaster risks., Report prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. PwC (PricewaterhouseCoopers). 2013.,UNISDR and PwC – Working together to reduce disaster risks., Report prepared for the 2013 Global Assessment Report on Disaster Risk Reduction., Geneva,Switzerland: UNISDR.. Click here to view this GAR paper. In addition, a process of positive and negative incentives and regular annual audits ensures increased and monitored levels of compliance (Ibid.). New initiatives towards developing integrated disaster risk management frameworks for the private sector (Figure 11.5) are promising steps in the direction of more effective business and public-private risk reduction.

Figure 11.4 Level of maturity using number of good practices as a proxy

(Source: PwC , 2013)

|

|