Please help us improve PreventionWeb by taking this brief survey. Your input will allow us to better serve the needs of the DRR community.

Natural catastrophes and man-made disasters in 2016: a year of widespread damages

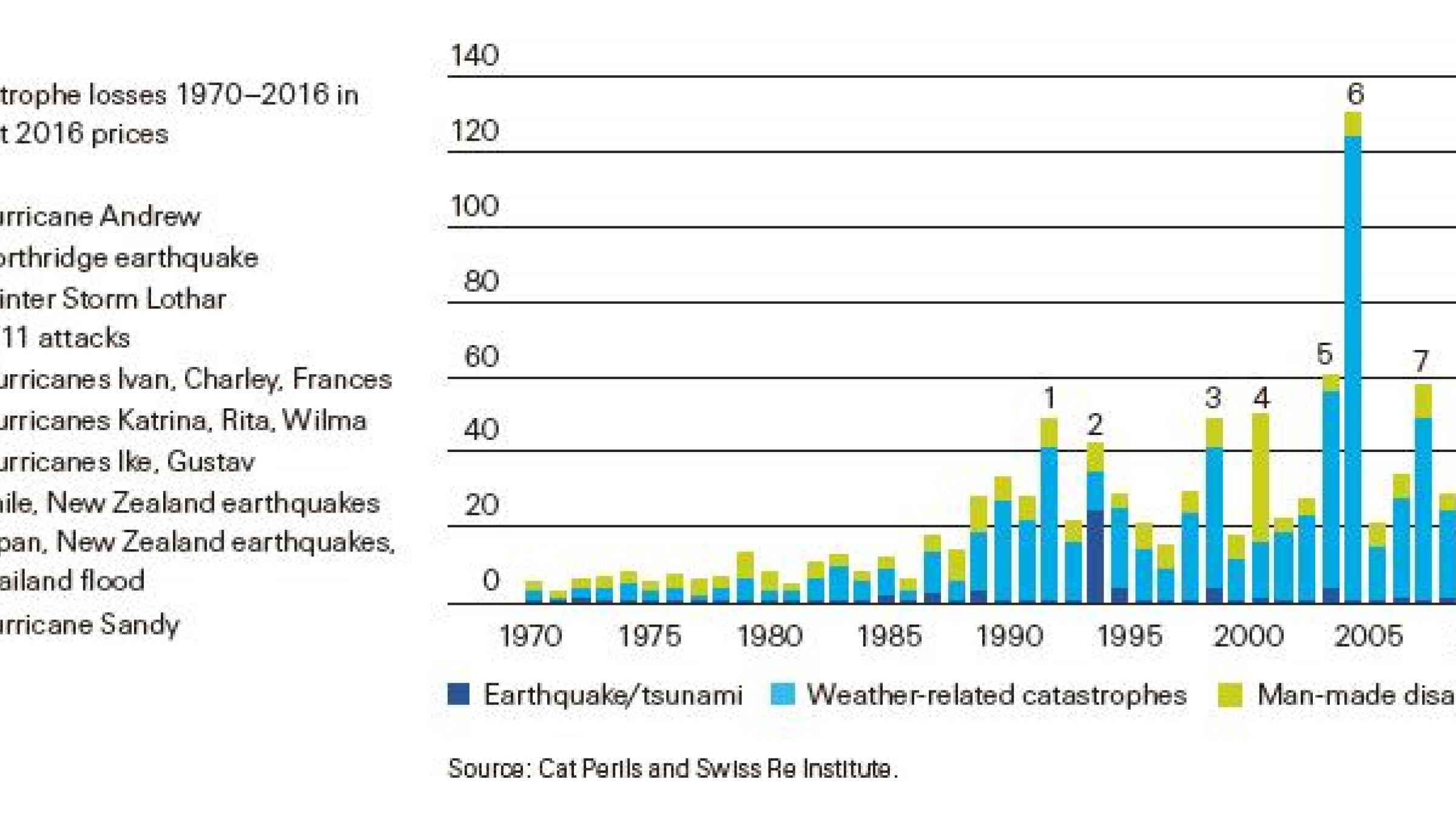

Total economic losses and global insured losses from natural catastrophes and man-made disasters in 2016 were the highest since 2012, reversing the downtrend of the previous four years.

Globally there were 327 disaster events in 2016, of which 191 were natural catastrophes and 136 were man-made. In total, the disasters resulted in economic losses of USD 175 billion, almost double the level in 2015. In terms of devastation wreaked, there were large-scale disaster events across all regions, including earthquakes in Japan, Ecuador, Tanzania, Italy and New Zealand. In Canada, a wildfire across the wide expanses of Alberta and Saskatchewan turned out to be the country's biggest insurance loss event ever, and the second costliest wildfire on sigma records globally.

Worldwide, around 11 000 people lost their lives or went missing in disasters in 2016. There were a number of severe flood events in 2016, in the US, Europe and Asia. Hurricane Matthew, the first Category 5 storm to form over the North Atlantic since 2007, was also a major humanitarian disaster. Matthew caused the largest loss of life – more than 700 deaths, mostly in Haiti – compared to all single events this year.

Notable increase in insurance payouts in 2016

Global insured losses last year were USD 54 billion, significantly higher than in 2015 and in line with the inflation-adjusted annual average of the previous 10-years (USD 53 billion). Natural catastrophes resulted in claims of USD 46 billion, the same as the 10-year annual average. Insured losses from man-made disasters were USD 8 billion, down from USD 10 billion in 2015.

Insurance covered around 30% of the global economic losses resulting from disaster events in 2016. Some areas fared much better than others because of higher insurance penetration. For example, North America accounted for more than half the global insured losses. This was largely due to a record number of severe convective storms in the US, and because the level of insurance penetration for such storm risks in the US is high. The costliest was a hailstorm that struck Texas in April, resulting in economic losses of USD 3.5 billion, of which USD 3 billion, or 86%, were covered by insurance. With insurance, many households and businesses benefitted from insurance payouts for the heavy damage to their property caused by large hailstones.

However, insurance cover is not universal. Table 1 indicates the shortfall in insurance relative to total economic losses from all disasters events – the protection gap – was USD 121 billion in 2016. Under-insurance against catastrophe risk is a reality in both advanced and emerging markets, and there is still large opportunity for the industry to help strengthen worldwide resilience.

Explore further

Please note: Content is displayed as last posted by a PreventionWeb community member or editor. The views expressed therein are not necessarily those of UNDRR, PreventionWeb, or its sponsors. See our terms of use

Is this page useful?

Yes No Report an issue on this pageThank you. If you have 2 minutes, we would benefit from additional feedback (link opens in a new window).