|

Global Assessment Report on Disaster Risk Reduction 2015

Making development sustainable: The future of disaster risk management |

|

Global Assessment Report on Disaster Risk Reduction 2015

Making development sustainable: The future of disaster risk management |

|

|

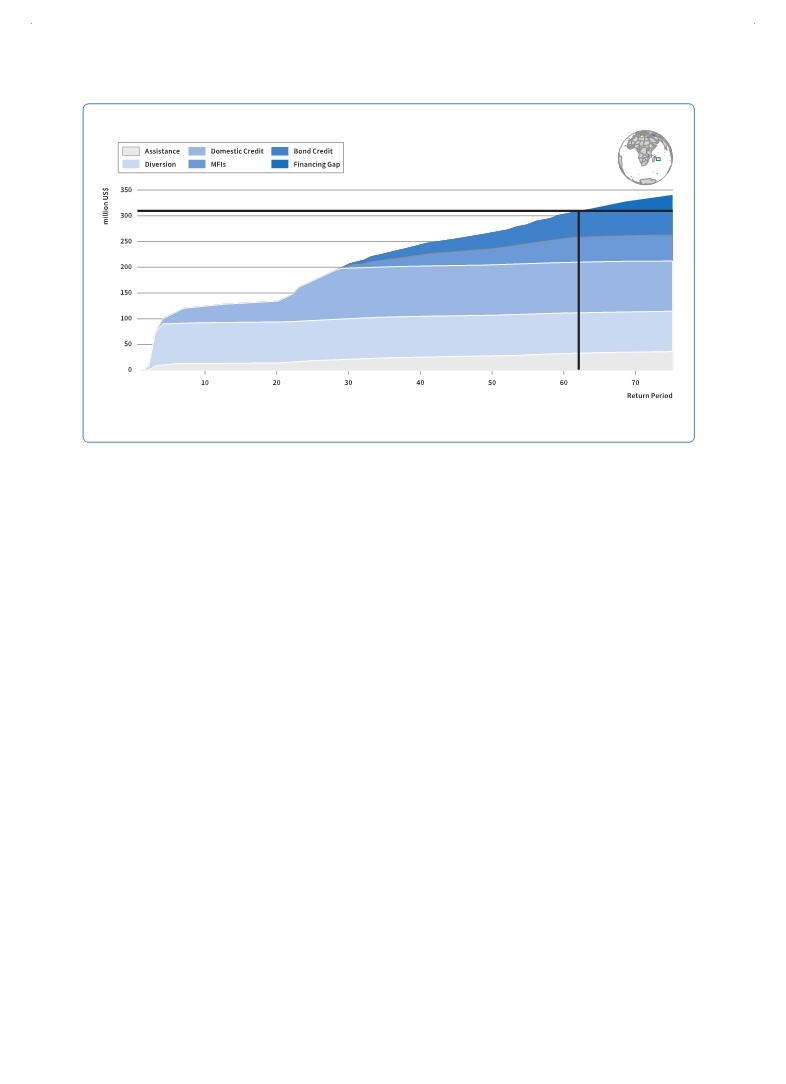

Note: MFIs = multilateral financial institutions.

104

Part I - Chapter 5

In addition to ex-ante financing mechanisms, investments in disaster risk reduction measures are expected to significantly reduce the expected negative impact of disasters on economic growth (UNISDR, 2013a

UNISDR. 2013a,Global Assessment Report on Disaster Risk Reduction: From Shared Risk to Shared Value: the Business Case for Disaster Risk Reduction, Geneva, Switzerland: UNISDR.. . In countries with very low rates of capital investment, recovery may take years if disasters destroy a significant proportion of their capital stock. Countries with small and vulnerable economies

have particularly low resilience, as their entire economy may be devastated; if they also have limited fiscal manoeuvrability, they may also have difficulties financing a recovery (UNISDR, 2009a

UNISDR. 2009a,Global Assessment Report on Disaster Risk Reduction: Risk and Poverty in a Changing Climate, Geneva, Switzerland: UNISDR.. . The cumulative effect of disaster loss on fixed capital may be dramatic in SIDS such as Vanuatu (Figure 5.5) or small countries like Belize.5 It is estimated that Belize has lost almost 18 per cent of its accumulated capital investment since 1970 due to the cumulative effects of disasters over the past 20 years. For Vanuatu, this amounts to a full 24 per cent of capital investment since 1970. However, even in higher-income small island states, economic losses can also have a highly disruptive effect on economic development. For example, the Cayman Islands suffered significant losses from Hurricane Ivan in 2004 and its economy still has not recovered fully, leading to a reduction of cumulative capital investment by almost 23 per cent since 1970.

In contrast, large economies such as China or Mexico seem to have sufficient capacity to absorb

(Source: Mochizuki et al., 2014

Mochizuki, Junko, Stefan Hochrainer, Keith Wil-liges and Reinhard Mechler. 2014,Fiscal and Economic Risk of Natural Disasters in Comoros, Mauritius, Seychelles and Zanzibar, CATSIM Assessment (Preliminary Result). Risk Policy and Vulnerability Program, International Institute for Applied Systems Analysis (IIASA).. . Figure 5.4 Financing gap for cyclone wind and earthquake risk in Mauritius

|

Page 1Page 10Page 20Page 30Page 40Page 50Page 60Page 70Page 80Page 90Page 94Page 95Page 96Page 97Page 98Page 99Page 100Page 101Page 102Page 103Page 104Page 105->Page 106Page 107Page 108Page 109Page 110Page 111Page 112Page 113Page 114Page 115Page 116Page 117Page 118Page 120Page 130Page 140Page 150Page 160Page 170Page 180Page 190Page 200Page 210Page 220Page 230Page 240Page 250Page 260Page 270Page 280Page 290Page 300Page 310

|

|

|

|