|

Global Assessment Report on Disaster Risk Reduction 2015

Making development sustainable: The future of disaster risk management |

|

Global Assessment Report on Disaster Risk Reduction 2015

Making development sustainable: The future of disaster risk management |

|

|

102

Part I - Chapter 5

for recovery, reallocating funding and reducing the available future borrowing capacity for development as well, thus hampering future growth.

In most higher-income countries, a significant proportion of economic losses are insured. For example, in the July 2013 hailstorms in Germany and France, an estimated US$3.8 billion of the total losses of US$4.8 billion were insured, as were US$1.9 billion of the total losses of US$4.7 billion in the June 2013 floods in Canada (Swiss Re, 2014a). Furthermore, despite their size in absolute terms, these losses are rarely significant compared with annual capital investment in those countries.

In contrast, many countries with lower incomes and smaller economies, including least developed countries (LDCs) and small island developing states (SIDS), are severely challenged by rising economic loss. In such countries, most loss is uninsured and governments do not have the financial reserves or access to contingency financing that would allow them to absorb losses,

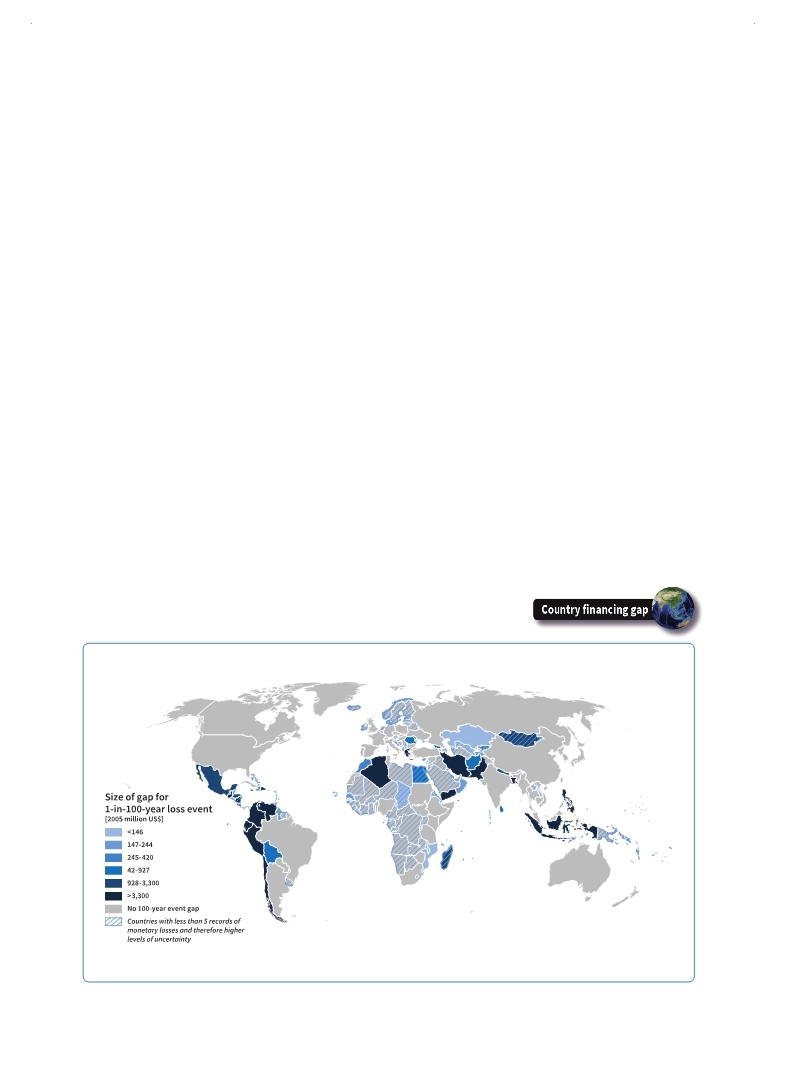

recover and rebuild. For example, while estimates of the total losses from Typhoon Haiyan vary, there is agreement that insured losses are only a small fraction of the overall loss due to low insurance penetration in the region. For example, AIR Worldwide estimates total damage at US$6.5 billion to US$14.5 billion, of which only US$300 million to US$700 million are thought to be insured.1 In fact, a considerable number of countries face resource gaps for events with return periods below 100 years. For example, while Canada and the United States would only face challenges in absorbing the impact from a 1-in-500-year loss, Algeria, Bolivia, Chile, Indonesia, Iran, Madagascar, Mozambique and Pakistan would face difficulties finding the resources to absorb the impact from as small as a 1 in 3-25 year loss (

Williges et al., 2014 Williges et al., 2014 Williges, Keith, Stefan Hochrainer-Stigler, Junko Mochizuki and Reinhard Mechler. 2014,Modeling the indirect and fiscal risks from natural disasters: Emphasizing resilience and “building back better”, Background Paper prepared for the 2015 Global Assessment Report on Disaster Risk Reduction. Geneva, Switzerland: UNISDR.. Williges, Keith, Stefan Hochrainer-Stigler, Junko Mochizuki and Reinhard Mechler. 2014,Modeling the indirect and fiscal risks from natural disasters: Emphasizing resilience and “building back better”, Background Paper prepared for the 2015 Global Assessment Report on Disaster Risk Reduction. Geneva, Switzerland: UNISDR.. Click here to view this GAR paper. (Source:

Williges et al., 2014 Williges et al., 2014 Williges, Keith, Stefan Hochrainer-Stigler, Junko Mochizuki and Reinhard Mechler. 2014,Modeling the indirect and fiscal risks from natural disasters: Emphasizing resilience and “building back better”, Background Paper prepared for the 2015 Global Assessment Report on Disaster Risk Reduction. Geneva, Switzerland: UNISDR.. Williges, Keith, Stefan Hochrainer-Stigler, Junko Mochizuki and Reinhard Mechler. 2014,Modeling the indirect and fiscal risks from natural disasters: Emphasizing resilience and “building back better”, Background Paper prepared for the 2015 Global Assessment Report on Disaster Risk Reduction. Geneva, Switzerland: UNISDR.. Click here to view this GAR paper. Figure 5.2 Countries facing a financing gap for a 1-in-100-year loss event

|

Page 1Page 10Page 20Page 30Page 40Page 50Page 60Page 70Page 80Page 90Page 92Page 93Page 94Page 95Page 96Page 97Page 98Page 99Page 100Page 101Page 102Page 103->Page 104Page 105Page 106Page 107Page 108Page 109Page 110Page 111Page 112Page 113Page 114Page 115Page 116Page 120Page 130Page 140Page 150Page 160Page 170Page 180Page 190Page 200Page 210Page 220Page 230Page 240Page 250Page 260Page 270Page 280Page 290Page 300Page 310

|

|

|

|